Independent Living Costs 2024

The cost of independent living for adults can vary significantly depending on several factors, including:

Location: Costs are generally higher in larger cities and desirable coastal areas compared to smaller towns and rural locations.

Type of community: Options range from basic senior apartments to luxurious communities with extensive amenities and services.

Size and features of the unit: Studio apartments will be cheaper than larger units with multiple bedrooms and balconies. Additional features like in-unit laundry or patios can also increase the cost.

Level of care needed: Some independent living communities offer optional services like housekeeping, meal plans, or transportation, which add to the monthly fees.

Additional fees: Be aware of potential entrance fees, parking fees, and pet fees.

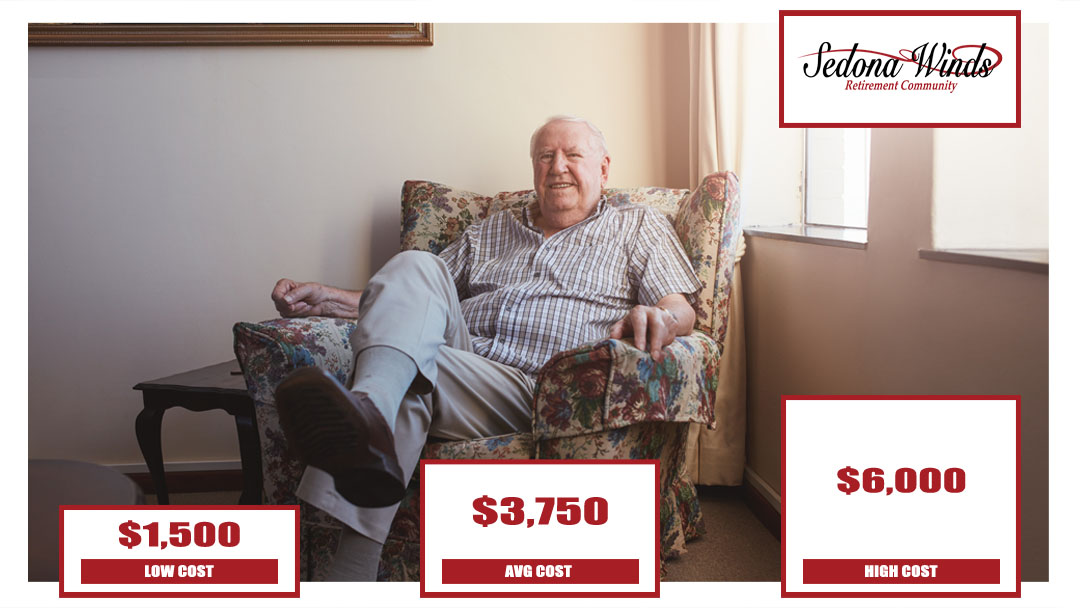

Here’s a general breakdown of costs:

- Average monthly rent: $1,500 – $10,000

- Entrance fee (optional): $5,000 – $50,000+

Resources for estimating costs:

- A Place for Mom: https://www.aplaceformom.com/

- Genworth Financial: https://www.genworth.com/

- CostHelper: https://www.costhelper.com/

Here are some tips for saving money on independent living:

- Consider a smaller community or location: Smaller communities and those located in less expensive areas typically have lower costs.

- Choose a basic apartment: Opt for a smaller unit without unnecessary features.

- Cook your own meals: Opting out of meal plans can save money.

- Utilize public transportation: If available, using public transportation instead of paying for parking can be cheaper.

- Compare quotes from different communities: Get quotes from several communities before making a decision.

Remember: Independent living can be a great option for adults who want to maintain their independence but enjoy the benefits of a supportive community. Carefully consider your needs and budget when choosing a community to ensure you find the right fit at the right price.

Amenities With Assisted Living

Assisted living communities offer a wide range of amenities and services to cater to the diverse needs of their residents. While specific offerings can vary between communities, here’s a general overview of what you can expect:

Essential Services:

- Personal care assistance: Help with bathing, dressing, grooming, toileting, and medication management.

- Meals and dining: Three daily meals served in a restaurant-style setting, often with dietary accommodations available.

- Housekeeping and laundry services: Regular cleaning of apartments and care for laundry needs.

- Emergency call systems: 24/7 access to staff for assistance in case of emergencies.

- Transportation: Scheduled transportation for errands, appointments, and social outings.

Additional Amenities and Services (may vary):

- Social and recreational activities: Organized events, fitness classes, games, arts & crafts, and entertainment programs.

- Wellness and health programs: On-site fitness centers, health screenings, and educational workshops.

- Beauty salon and barber services: Hairstyling, manicures, and other personal grooming services.

- Pet-friendly policies: Some communities welcome pets with specific guidelines.

- Guest accommodations: Designated spaces for visiting family and friends.

- Religious services: On-site or nearby chaplaincy services for various faiths.

- Technology support: Assistance with using technology and communication devices.

- Security features: Secured buildings, controlled access, and emergency response protocols.

Sedona Winds Retirement Offers Independent Living In Sedona

Sedona Winds Retirement Community offers independent living, memory care, and assisted living in Sedona, Arizona. Call us today at 928-985-6259 and learn more about our facility and what we have to offer today’s seniors.

More Articles About Assisted Living

- Funny Christmas Quotes For Seniors

- Best Things To Do In Sedona For Seniors

- Tips On How To Save For Retirement Without A 401k

- Physical Games For Seniors

- Retiring in Arizona Pros and Cons

- Best Places To Retire In Arizona 2020 | Retirement Communities

- Benefits of Independent Living

- Inspirational Retirement Quotes

- What Is Dementia?

- Memory Care Checklist: What To Ask & Look For

- What is Memory Care? | Questions to ask the Facility

- Senior Living Sedona

- Moving A Parent With Dementia into Assisted Living

- Common Senior Health Issues

- Benefits Of Assisted Living

- How Much Does Assisted Living Cost In Sedona Arizona?

- Assisted Living Checklist: What To Ask & What To Look For

- Biggest Reasons To Retire In Arizona

- Assisted Living Camp Verde

- Find Memory Care Facilities In Arizona

- Things to Do in Sedona for Retirees

- Quotes & Sayings For Retirement Cards – 110 Quotes – Continued

- Why Retire In Sedona Arizona?

- Why Do People Retire? Answered