Retiring to Sedona

Retiring to Sedona, Arizona can be a dream come true for many—offering stunning red rock landscapes, a mild four-season climate, a strong wellness community, and a peaceful lifestyle. But before you pack your bags, here’s a clear, practical guide to help you decide if Sedona is right for your retirement.

️ Why People Retire to Sedona

✅ Pros:

-

Breathtaking Scenery

-

Iconic red rock formations, national forests, and hiking trails everywhere.

-

Outdoor activities: hiking, biking, birdwatching, golf.

-

-

Mild Climate (By Arizona Standards)

-

4 seasons: warm summers (but not Phoenix-hot), cool winters with occasional snow.

-

Elevation: ~4,350 feet, offering cooler temperatures than low desert cities.

-

-

Vibrant Wellness Culture

-

Home to spas, yoga retreats, alternative medicine, and meditation centers.

-

“Vortex” energy sites draw spiritual travelers and healers.

-

-

Safe and Peaceful Living

-

Low crime rate, quiet pace.

-

Ideal for peaceful retirement without urban chaos.

-

-

Small-Town Charm with Upscale Perks

-

Boutique shopping, art galleries, gourmet dining.

-

Several retirement-friendly communities, including gated neighborhoods.

-

Housing and Cost of Living

| Expense Category | Sedona Average (2025) | Notes |

|---|---|---|

| Median Home Price | ~$790,000 | Much higher than the AZ average |

| Rent (2-bed) | $2,000–$2,800/mo | Limited inventory, high demand |

| Utilities | ~$200/mo | Mild temps = lower cooling costs than Phoenix |

| Groceries | 10–15% above national avg | Tourist pricing on some goods |

| Healthcare Access | Moderate | Nearby Cottonwood has major hospital |

TIP: Retirees often explore nearby Cottonwood or Village of Oak Creek for lower home prices and similar views.

Healthcare in Sedona

-

Primary providers: Verde Valley Medical Center (in Cottonwood), urgent care clinics in Sedona.

-

Sedona has several holistic and alternative care options.

-

For major specialists or surgery, Flagstaff or Phoenix (~1–2 hours away) are typical.

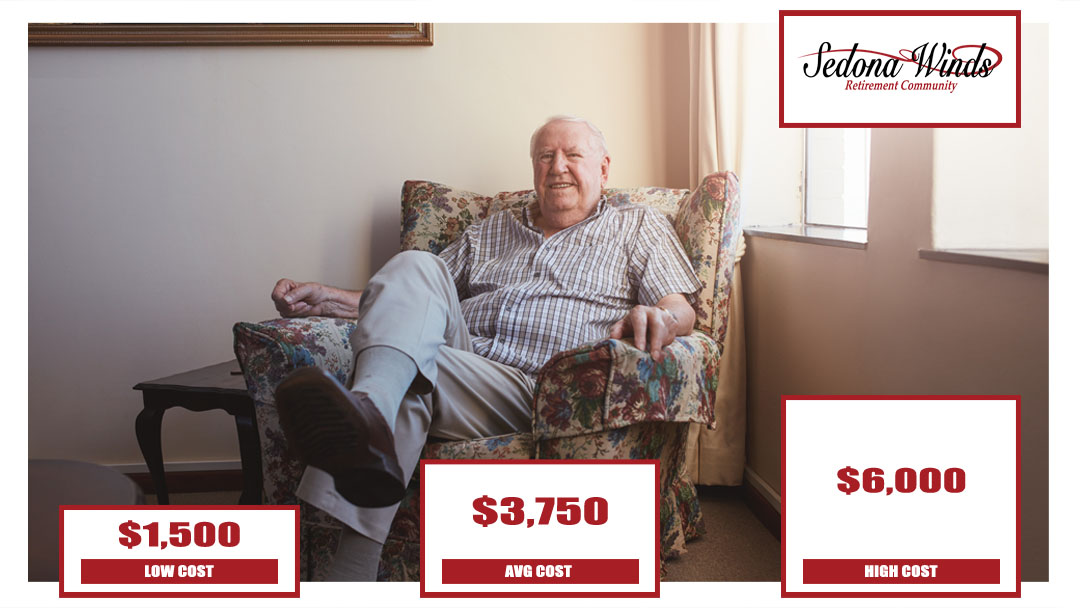

Senior & Retirement Communities

-

55+ communities are limited within Sedona, but common in surrounding areas.

-

Examples:

-

Sedona Shadows (manufactured homes, clubhouse, pool)

-

The Ridge at Sedona (resort-style condos)

-

Cottonwood Ranch (popular for retirees seeking affordability)

-

Lifestyle & Community

-

Spiritual and wellness-oriented community (meditation, sound healing, reiki)

-

Large art and cultural presence: First Friday Art Walks, film festivals, sculpture gardens

-

Easy day trips to: Flagstaff, Jerome, Prescott, Grand Canyon

Challenges or Downsides

| Concern | Notes |

|---|---|

| Housing Costs | Higher than national and Arizona average |

| Tourism Traffic | Can be congested during weekends and peak seasons |

| Limited Medical Care | Some retirees prefer proximity to full-service hospitals |

| Not Walkable | A car is necessary for daily living |

| Low Nightlife | Quiet evenings, not ideal for nightlife seekers |

Is Sedona Right for You?

| Preference | Sedona is a Good Fit? |

|---|---|

| Love nature & hiking | ✅ Yes |

| Prefer quiet, small-town living | ✅ Yes |

| Need constant nightlife or big city vibe | ❌ No |

| Want affordability | ❌ Not ideal |

| Interested in spiritual or wellness lifestyle | ✅ Absolutely |

The Cost Of Living in Sedona for Seniors

The cost of living in Sedona, Arizona for seniors is higher than both the national and Arizona average, largely due to housing costs and the premium lifestyle Sedona offers. However, many retirees find the natural beauty, wellness-oriented culture, and peaceful small-town environment worth the investment.

Here’s a full breakdown tailored for seniors:

Estimated Monthly Budget for a Senior in Sedona (2025)

| Expense Category | Estimated Cost (Single Senior) | Notes |

|---|---|---|

| Housing (Rent/Mortgage) | $1,800 – $3,200+ | Depends on home ownership, HOA fees, or rent |

| Utilities | $150 – $250 | Low cooling needs due to elevation |

| Groceries | $400 – $600 | Organic/health foods are common and cost more |

| Transportation | $200 – $400 | Car ownership is necessary |

| Healthcare | $400 – $800 | Medicare + supplemental plan recommended |

| Entertainment/Leisure | $100 – $300 | Dining out, art galleries, spiritual retreats |

| Miscellaneous | $100 – $200 | Clothing, gifts, personal items |

Total (Owner with no mortgage): ~$2,200 – $3,200/month

Total (Renter or mortgage): ~$3,200 – $4,800/month

Housing for Seniors

Sedona has limited 55+ communities, and no large-scale retirement complexes. Most seniors either:

-

Own a home or condo (high upfront cost, lower monthly)

-

Rent a home, casita, or apartment (higher monthly cost, less maintenance)

| Option | Cost (2025 Est.) |

|---|---|

| 1BR Apartment (rent) | $1,800 – $2,400/month |

| 2BR Home (rent) | $2,400 – $3,200/month |

| Median Home Price | ~$790,000 |

| Property Taxes | ~0.6% of assessed value |

| HOA Fees (some areas) | $50 – $300/month |

Healthcare Costs for Seniors in Sedona

-

Nearby Hospital: Verde Valley Medical Center (in Cottonwood)

-

Medicare is widely accepted.

-

Supplemental insurance plans recommended for specialists or emergencies.

-

Many retirees factor in trips to Flagstaff or Phoenix for advanced care.

| Healthcare Service | Typical Cost Range |

|---|---|

| Medicare + Supplement | $300 – $600/month |

| Doctor Visit (out of pocket) | $100 – $150 |

| Prescription Copays | $0 – $50 |

| Alternative Therapies | $50 – $150/session |

Transportation

-

No robust public transportation—car required

-

Uber/Lyft is available but limited

-

Senior transportation programs exist in nearby Cottonwood or through local nonprofits

Groceries & Dining

-

Groceries 10–15% higher than national average

-

Organic and specialty wellness items more common (and costly)

| Example Item | Sedona Price (2025) |

|---|---|

| Gallon of Milk | $4.50 |

| Dozen Eggs (Organic) | $6.00 |

| Sit-down Lunch for Two | $35 – $50 |

| Farmers Market Veggies | Premium priced but fresh |

Entertainment & Lifestyle

-

Art galleries, hiking, spirituality centers, nature tours

-

Many free or low-cost outdoor options

-

Frequent wellness workshops and retreats (can be expensive)

Best Ways for Seniors to Save in Sedona

-

Live in Village of Oak Creek: Lower housing costs, same scenery

-

Use Medicare Advantage plans with local provider networks

-

Join local senior or community centers for classes and support

-

Volunteer or part-time work in local tourism or art communities

Comparing Sedona, Cottonwood and Prescott As Places To Retire

Sedona, Cottonwood, and Prescott are three of Northern Arizona’s most popular retirement destinations, each offering a distinct lifestyle. Here’s a side-by-side comparison to help you decide which community fits your retirement goals, lifestyle, and budget:

1. Quick Snapshot: Overview Comparison

| Feature | Sedona | Cottonwood | Prescott |

|---|---|---|---|

| Vibe | Scenic, spiritual, artsy | Small-town, practical | Historic, outdoorsy, vibrant |

| Elevation | ~4,350 ft | ~3,300 ft | ~5,300 ft |

| Climate | Mild 4 seasons, warm summers | Hotter summers | Cooler winters with light snow |

| Median Home Price | ~$790,000 | ~$380,000 | ~$540,000 |

| Population | ~10,000 | ~13,000 | ~46,000 |

| Medical Access | Nearby in Cottonwood | Full-service hospital | Full medical services + VA hospital |

| Cost of Living | (High) | (Affordable) | (Moderate) |

| Traffic/Tourism | Heavy in peak seasons | Low tourist traffic | Moderate year-round tourism |

| Walkability | Low | Moderate | Moderate to high (downtown) |

2. Cost of Living Comparison

| Category | Sedona | Cottonwood | Prescott |

|---|---|---|---|

| Median Rent (2BR) | $2,400–$3,200/mo | $1,400–$1,800/mo | $1,800–$2,400/mo |

| Home Price (Median) | ~$790,000 | ~$380,000 | ~$540,000 |

| Utilities (monthly) | $150–$250 | $140–$220 | $160–$240 |

| Groceries | 10–15% above avg | Average | Slightly above avg |

| Healthcare Insurance | $400–$800/month | $350–$750/month | $400–$800/month |

Winner for Affordability: Cottonwood

3. Healthcare & Senior Services

| Feature | Sedona | Cottonwood | Prescott |

|---|---|---|---|

| Primary Hospital | In Cottonwood (15 min) | Verde Valley Medical Center | Yavapai Regional Medical Center |

| VA Medical Center | ❌ None nearby | ❌ | ✅ Large VA hospital |

| Specialists Availability | Limited locally | Moderate | Excellent |

| Senior Centers & Programs | Limited | Active programs available | Extensive senior services |

Winner for Healthcare Access: Prescott

4. Lifestyle & Community Comparison

| Lifestyle Category | Sedona | Cottonwood | Prescott |

|---|---|---|---|

| Activities | Art, hiking, spirituality, retreats | Community events, river trails | Festivals, hiking, historic downtown |

| Climate Comfort | 4 seasons, dry and mild | Hotter summers | Cooler winters, mild summers |

| Outdoor Recreation | Red Rock hiking, yoga, stargazing | Verde River, wineries, biking | Lakes, mountains, national forests |

| Nightlife | Very limited | Very limited | Modest: restaurants, live music |

| 55+ Communities | Few, luxury priced | Several, affordable | Several, moderately priced |

Winner for Vibrant Senior Life: Prescott

Winner for Scenic & Spiritual Lifestyle: Sedona

Best for What Type of Retiree?

| Preference | Best Choice |

|---|---|

| Natural beauty + peaceful retreats | Sedona |

| Budget-conscious + friendly town | Cottonwood |

| Well-rounded active retirement | ️ Prescott |

| Access to VA services | Prescott |

| Minimal traffic + small-town feel | ️ Cottonwood |

| Artistic, wellness-oriented living | Sedona |

Final Thoughts:

-

Sedona is ideal if you value spiritual living, desert beauty, and are financially comfortable.

-

Cottonwood is a great choice for a relaxed, budget-friendly lifestyle with basic amenities.

-

Prescott offers the best balance of affordability, healthcare, activities, and senior infrastructure.